- Product

- Company

-

Solutions

By Use CaseBy Industry

- Partnership

-

Resources

Maximise efficient collaboration between all parties and empower your managers, with real-time multi-user budgeting

Modern businesses need guidelines and systems of how to effectively manage their funds as the market is constantly changing. Annual budgeting gives businesses the necessary stability to plan and structure their funds leveraging the maximum effectiveness of decisions. Key aspects of a successful budgeting process and the subsequent accuracy of budgets include:

The above budgeting processes using traditional spreadsheet software at a corporate scale is fraught with perils, from version control to calculation and consistency issues. Moving to a cloud-based planning platform ensures budgeting cycles run smoothly and budgets remain reliable and accurate, year after year.

By connecting our enterprise modelling software with Excel Workbooks and any ERP, MODLR creates a scalable and fully collaborative planning environment.

Embedded workflow reports provide an understanding of the progress of the planning process, and who is causing any delays.

Collaborate with users in real-time to edit and fix budgets without the hassle of manual distribution. Unnecessary delays are avoided, and budgets are always up-to-date.

The methodology of creating budgets, and algorithms will be the same across the entire company, simplifying the budgeting cycle.

With real-time calculations, connected updates across strategies and plans, budgets will be thoroughly revised, staying accurate and reliable.

Interconnection of budgets with strategic information and plans allows for agile and informed decision making for businesses.

Connect to your ERP to automatically pull the most recent actuals

Plan and Report on MODLR models from within Excel Workbooks.

View Audit reporting of who changed what, and when

Collect commentary on variances between actuals, budgets and forecasts

Apply business logic across models globally, not in fits and starts across specific cells in certain spreadsheets

Send emails or SMS alerts when submissions are made to the budget

Quantify the financial impact of your changing operational drivers

MODLR can adapt to different types of budgeting styles and methods, such as zero-based budgeting

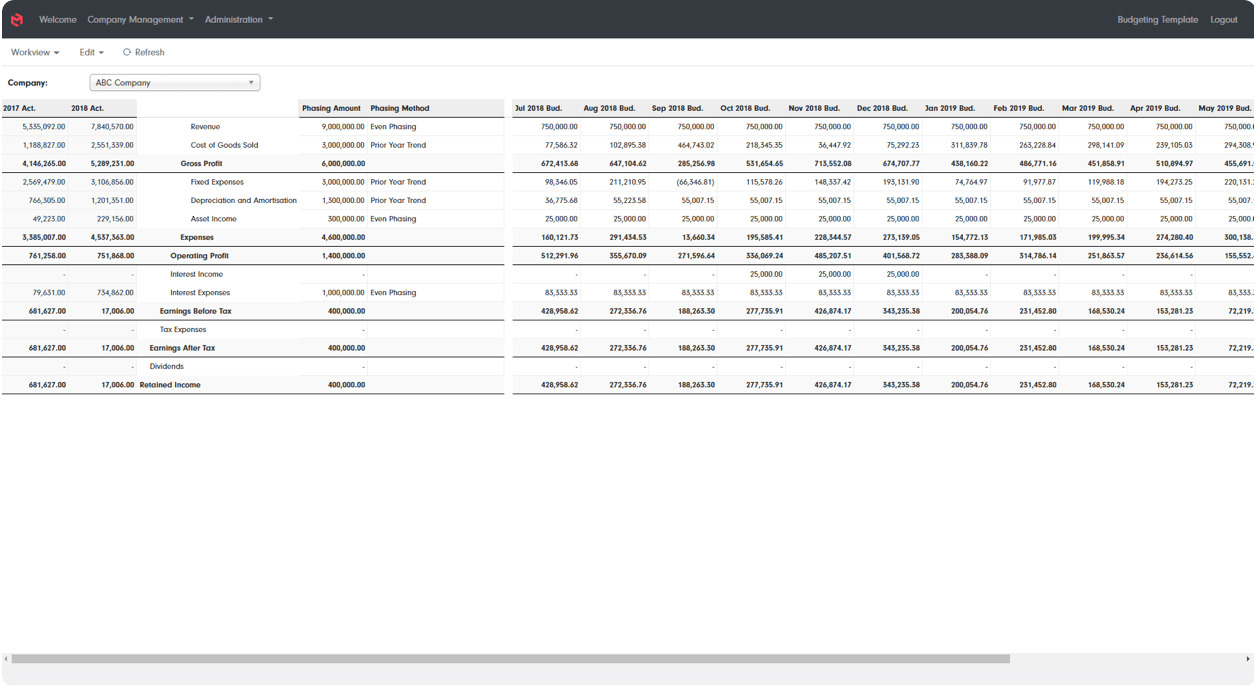

Budget flexibly and budget the way you want to with MODLR's customised phasing drivers. Pull trends from other areas of a model, use prior-year trends, phase out yearly targets or just enter numbers manually. With MODLR you don't have to choose one system for all your accounts - you pick the one that works the best.

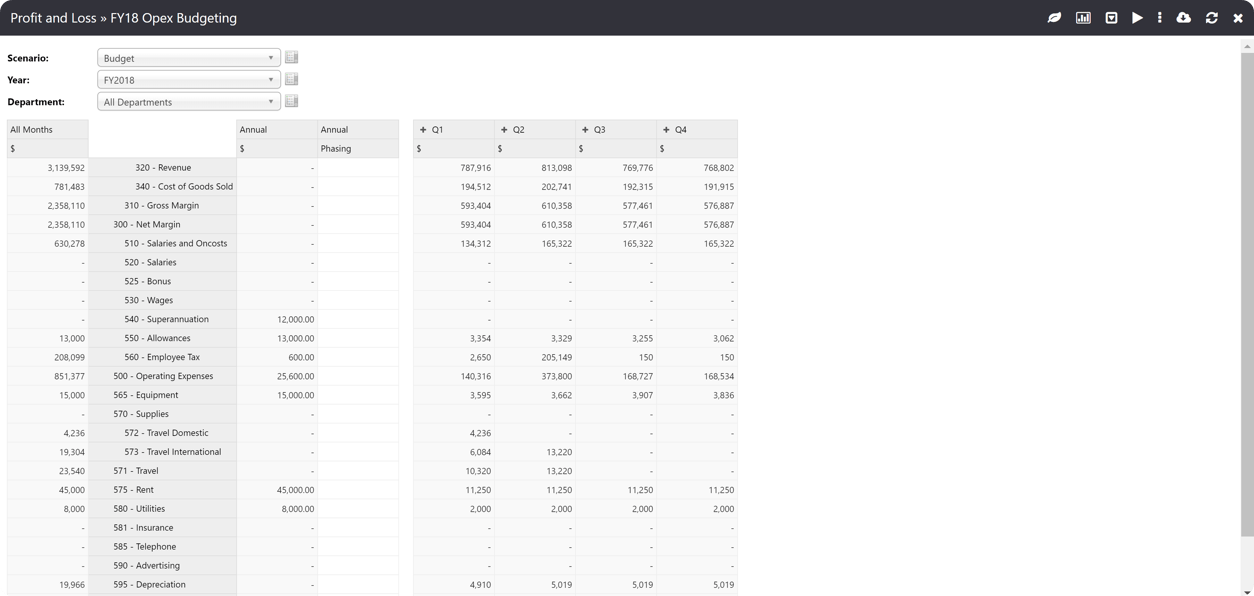

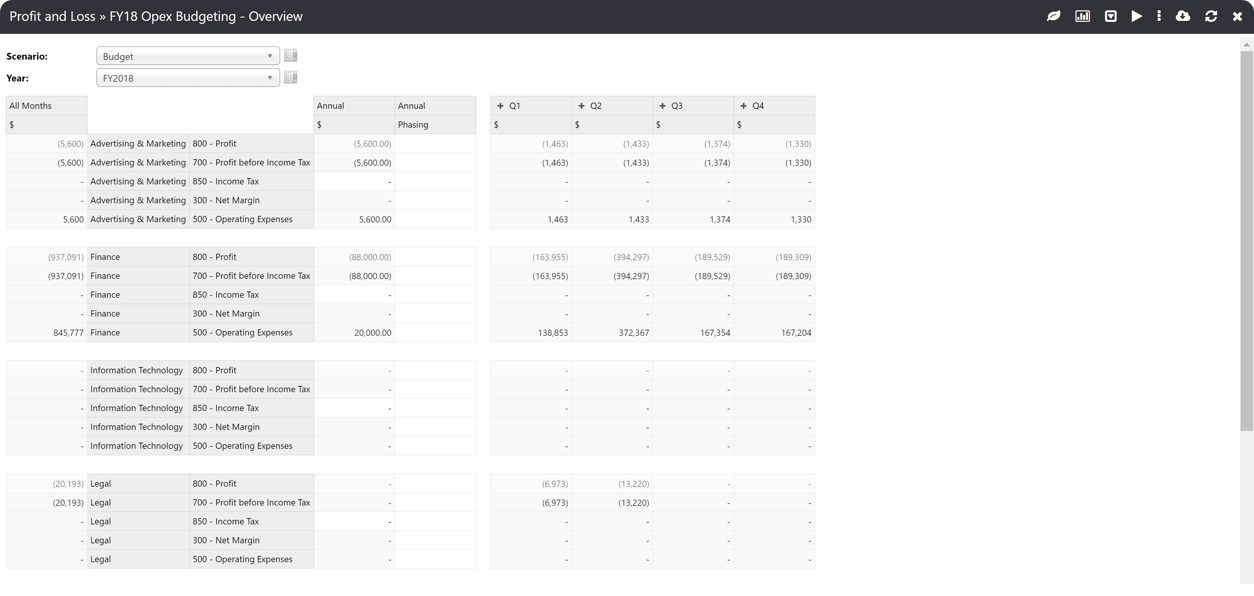

View your reports and the consolidated higher level before drilling down into the numbers to investigate any peculiarities. All values automatically consolidate along their dimensions for quick and simple summaries of large sets of data.

Stack Dimensions on rows or columns and easily choose the right area of the business with simple selectables. Avoid spending your time trawling through massive spreadsheets and go straight to the numbers you want to see.

Watch MODLR’s tutorial on how to build a price, discount, and volume planning workview; as well as master dimensions, cubes, and processes in the MODLR cloud.

To see the MODLR Cloud in action, schedule a personal demo with one of our modelling experts or watch an overview of the cloud platform.

Get a demo