- Product

- Company

-

Solutions

By Use CaseBy Industry

- Partnership

-

Resources

Measure budget, profitability, project milestones and improve operational efficiencies of your business through variance analysis.

Variance analysis provides the benefit of detecting and explaining any inconsistent trends in balance fluctuation, which is crucial for both internal efficiency and for internal and external auditing. The essential aspect is having an effective mechanism to identify accounts in such situations and establish controls that mandate explanations for them.

To improve profitability, it is essential to prioritize value-adding tasks and address root issues instead of focusing on unproductive ones. MODLR can automate the process of calculating and maintaining variance activity, which enables easy comparison of cumulative balance and individual account activity changes between different time periods.

Collaborative features facilitate speedy completion of variance analysis exercises and help prioritize critical items with versatile analytical tools.

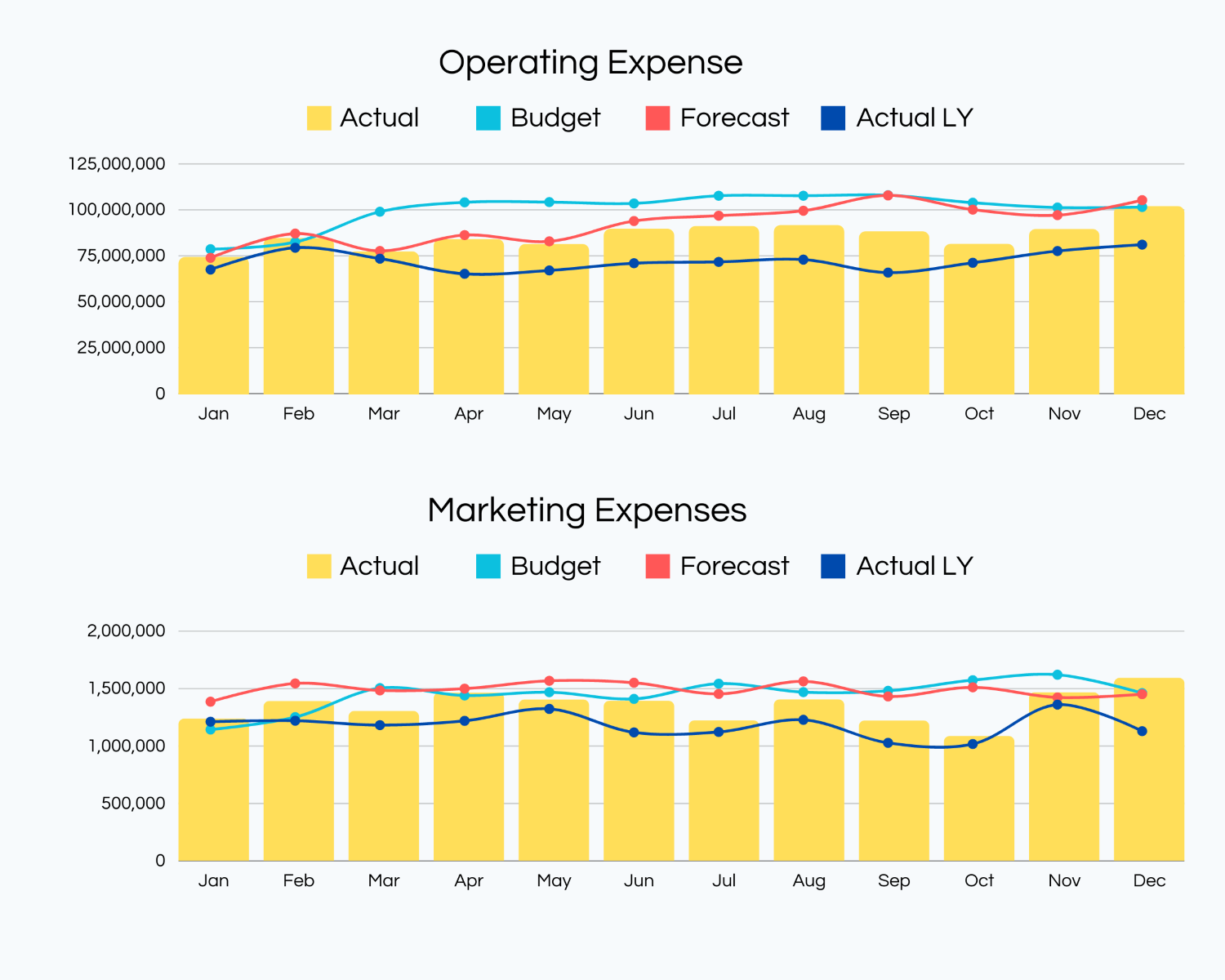

Customizable data visualizations provide flexibility without requiring coding skills. Use a range of visualizing tools, including waterfall analysis, bar graphs, and side-by-side charts, to perform month-end variance analysis. Highlight the most significant variances automatically.

Ability to facilitate large-scale, multi-site, and collaborative planning without any scalability limitations empowers geographically dispersed teams to engage in rich discussions and make faster decisions about highlighted and concerning variances.

Connect to your ERP to automatically pull the most recent actuals

Plan and Report on MODLR models from within Excel Workbooks.

View Audit reporting of who changed what, and when

Collect commentary on variances between actuals, budgets and forecasts

Apply business logic across models globally, not in fits and starts across specific cells in certain spreadsheets

Send emails or SMS alerts when submissions are made to the budget

Quantify the financial impact of your changing operational drivers

MODLR can adapt to different types of budgeting styles and methods, such as zero-based budgeting

With powerful financial analytics and dashboards, showcasing and disseminating business outcomes to stakeholders becomes effortless. This means you can devote more time to discussing the way forward rather than constructing reports.

Facilitate cross-functional teams with convenient access to both ad hoc and formatted reports on various aspects such as scenarios, metrics, actuals, etc. This will enable them to gain deeper insights into the factors that are contributing to the success of the business.

Made for every customer, MODLR can integrate with your favourite systems, boasting a wide range of pre-built integrations including Oracle, SAP, Sage, NetSuite, Microsoft Dynamics and so much more. MODLR’s data source expertise and flexible integration capabilities ensure that our cash flow forecating solution will provide you with an always up-to-date cash flow forecast.

To see the MODLR Cloud in action, schedule a personal demo with one of our modelling experts or watch an overview of the cloud platform.

Get a demo