CFO Challenges in 2023 and How MODLR Can Help

A Rocky Recovery. That is what the International Monetary Fund (IMF) titled its April 2023 World Economic Outlook. The IMF forecasts that global growth would drop from 3.4 percent in 2022 to 2.8 percent this year (2023) and settle around 3.0 percent by 2024. Those in advanced economies can expect to see an even more pronounced growth decline, to reach 1.3 percent this year, from 2.7 percent in 2022. The IMF does not neglect to mention an even more severe outcome for 2023, with growth in advanced economies dipping below 1 percent due to financial sector stress. The IMF projects that global headline inflation would fall to 7.0 percent from 8.7 percent in 2022, mainly attributable to lower commodity prices. However, the predictions are that the underlying or core inflation would decline at a slower pace.

Chart 1: 2023 Global and Regional Growth Projections

-(2000-%C3%97-900-px)-(1500-%C3%97-1000-px)-(3).png)

As Chart 1 shows, all key economic regions with the exception of Emerging and Developing Asia can expect to see significant drops in economic growth in 2023.

As the Financial Times reminded us leading up to 2023, The great disruption has only just begun and “history has shown that stability is, more often, the exception”.

“The new normal”, you say? There is nothing normal about the challenges companies face right now. CEOs must guide their companies through a confluence of disruptors: a war in Europe, surging inflation, energy insecurity, food shortages and the potential signs of a looming global recession. Don’t forget global warming and all its attendant headaches including adverse weather events, new diseases and land loss. And employees everywhere are rethinking work-life balance and opting out of regular work patterns.

Successfully guiding a company through all that is the CEOs job. Today’s CEOs are firefighting on many fronts as they look to guide their businesses to profitability and growth amidst all the turbulence.

Now is the time for CFOs to shine as CEOs around the world are looking increasingly towards their CFOs to solve the most pressing business challenges their companies face going forward.

According to McKinsey six priorities top the agendas of CEOs around the world:

- Resilience, to fall back, and spring ahead

- Courage to manage the downside while pursuing growth prospects

- Business building with new areas, in particular green tech

- Embracing better technology as the basis for growth via digital transformation and bringing software to the heart of their business, eve in non-tech firms

- A determination to stay the course on Net Zero because the goals of sustainability, economic competitiveness and affordability will come together to help mitigate impacts of inflation, energy insecurity and a potential global recession.

- Efforts to re-engage their employees, with new plans for engagement, tweaking the hybrid model, and bringing meaning to work lives, with a view to improving retention.

- Setting the Stage

- Today's CFOs have the chance to shine among the chaos

- How MODLR can support businesses and their CFOs

- Top CFO Concern #01: High inflation levels and their adverse impacts

- Two Top CFO Concerns come together:

- Pressure on hiring overall (#02) and hiring more people for data-driven jobs (#05)

- Managing a changing workforce

- Top CFO Concern #03: To solve supply chain issues, CFOs plan to invest more in operations.

- Top CFO Concern 04: CFOs are embracing new technologies and seeking technology integration

- Find out more about MODLR

Setting the Stage

CEO Business growth expectations are growing stronger.

According to the Winter 2023 Fortune/Deloitte CEO Survey, despite challenging times and CEO’s have stronger growth expectations with 45% of those participating expecting strong or very strong growth as compared to 34% in the Fall 2022 survey (Figure 1). Once you factor in modest growth expectations, the proportion increases to 88% compared to 85% in Fall 2022. (Figure 2).

-(1500-%C3%97-1000-px).png)

How CEOs described the year behind (2022) and the year ahead (2023) are revealing their mindset. Many characterized the year behind as challenging, and the new year as optimistic. It is easy enough to conclude that CEOs are optimistic by nature and they need to be to navigate business challenges ahead.

However, on a deeper level (Figures 3 and 4), it is clear that while the past year may have been volatile and challenging, it was also considered to be transformational, making companies stronger and resilient. In terms of 2023, the CEOs are optimistic. While focusing on opportunities and growth, they are also cognizant of the uncertainty and may move ahead with caution.

Future influencing and disrupting factors

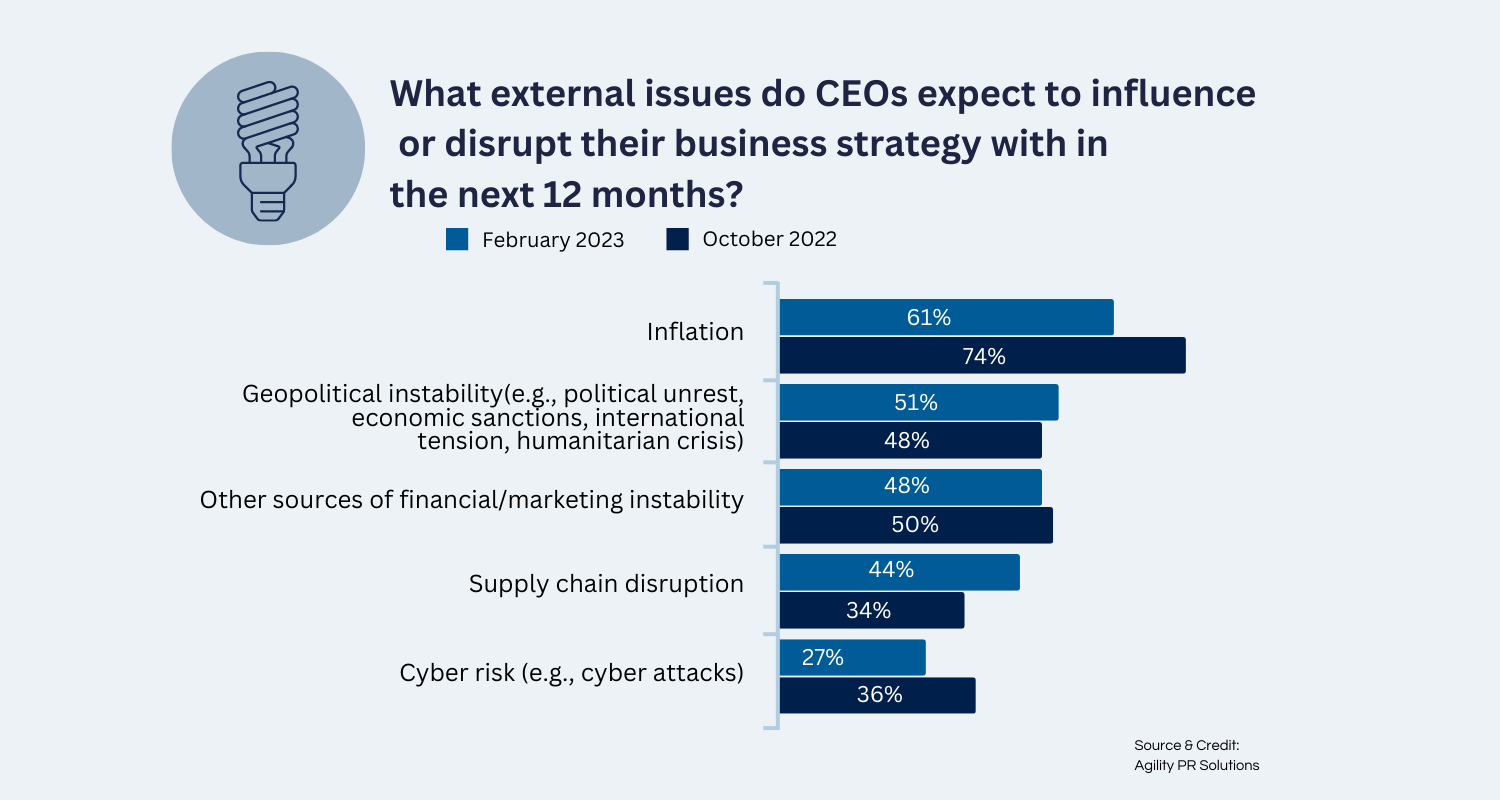

Compare what external issues CEOs expect to influence or disrupt their business strategy over the coming year (From Feb 2023).

The top three disruptors highlighted by the Winter CEO survey were Inflation (61%), geopolitical instability (51%), and shortages of labor/skills (48%).

Inflation

Inflation remains the top disruptor in 2023, but a fewer proportion of CEOs noted it as such compared to 2022 Fall survey (74%). CEO expectations were that inflation would decrease by mid year. But as the IMF forecasts, that is just not happening only to a limited degree in places.

Geopolitical instability

Over half (51%) of the CEOs expected geopolitical instability—stemming from political unrest, economic sanctions, international tensions, humanitarian crisis etc—to be the second biggest business disruptor during 2023. This was marginally higher from the proportion of CEOs who saw it as the second biggest disruptor in 2022 (48%).

Labour skills and shortages

While just under half of the CEOs (48%) saw labour and skill shortages as a key disruptor, the proportion of CEOs who thought this had declined marginally from Fall 2022 (50%).

The CEOs were also concerned about other sources of financial or market instability (44%) and supply chain disruptions (27%). Other factors that appeared in the survey results included risk of cyber attacks, environmental matters such as weather-related impacts, regulatory and reporting, crises of trust including spread of misinformation, and ideological polarisation. Few CEOs were also concerned about disruptions from pandemics caused by future COVID-19 variants.

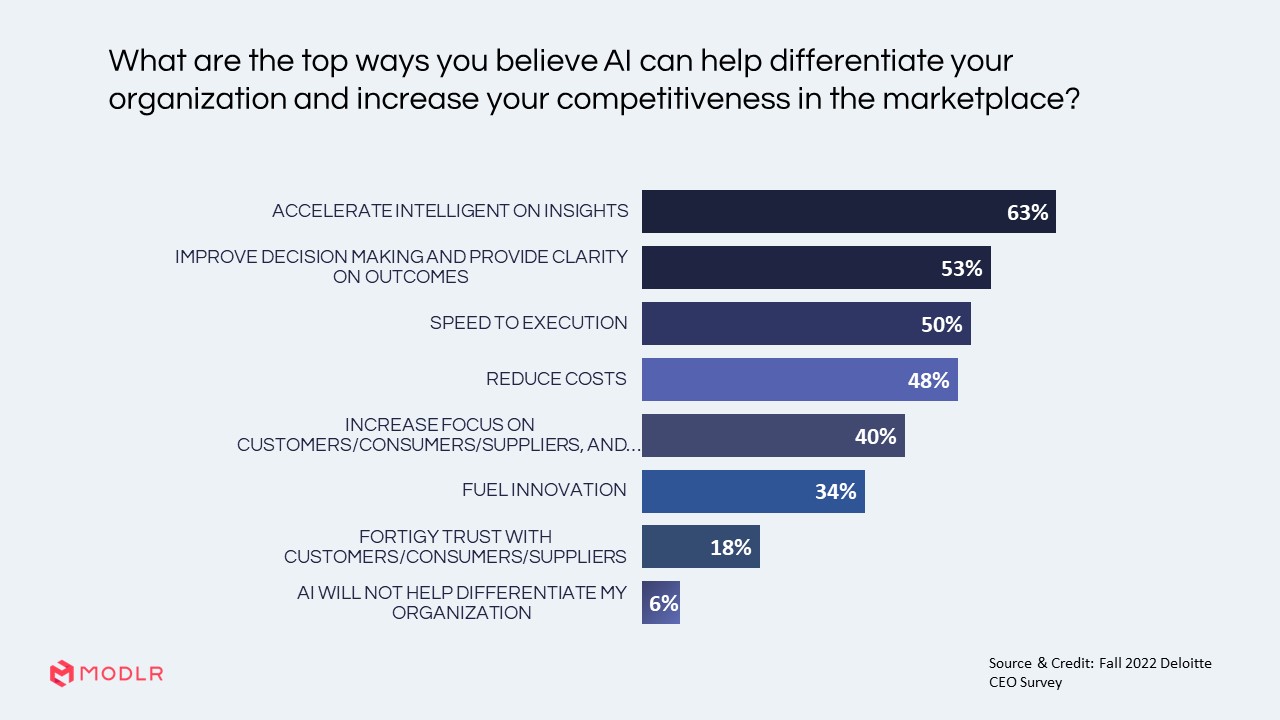

CEOs are acknowledging the compelling need to invest in AI

According to the Fall 2022 report, an overwhelming majority (91%) of CEOs said they were anticipating investments in artificial intelligence (AI) over the next 6 to 12 months. CEOs in the Fall survey said that they believed AI can help differentiate their organisations and increase their market competitiveness. Top five expected benefits are accelerating intelligent insights, improving decision making and offering clarity of outcomes, speeding up execution, potential for reducing costs and an increased focus on stakeholder relationships.

Deloitte's most recent findings show CEOs taking a pragmatic approach to AI. The majority seem to focus on the foundational aspects of AI technology "with most viewing it as a platform for advanced predictive analytics (85%), sophisticated data analysis (80%), and, to a somewhat lesser degree, recommendation engines (52%)."

Less than half of the CEOs (39%) viewed AI as a platform for generative AI and approximately a fourth (27%) envisioned AI serving as a platform for autonomous decision making. CEOs are cognizant of the implementation difficulties when using AI and barriers to creating business value. CEOs noted identifying the right use cases (55%), data challenges (51%), and organisational digital maturity and or technical capabilities (51%) as the biggest barriers. The study findings suggest that CEOs and their companies may not be fully prepared to benefit from emerging applications.

Today's CFOs have the chance to shine among the chaos

All of this spells good news for CFOs who are the top lieutenants that CEOs count on to meet the growth and other external challenges. Gone are the days when CFOs only needed to worry about the financial cost of capital and other money concerns. As a result, while the CFOs work on supporting their CEOs, they themselves have to deal with a parallel set of challenges and shuffle priorities in order to support ogranisational goals.

What are the top CFO concerns right now?

To find out what is keeping CFOs up at night, we turned to the CFO.com survey results outlined in 5 Top Challenges and Priorities CFOs Face in 2022.

- CFOs expect the adverse impacts of currently high levels of inflation may last up to two years.

- In spite of the strong need for staff, many CFOs are looking to halt hiring as a response to inflation.

- However, the need for more financial planning and analysis (FP&A) professionals is not something that can be avoided. Almost all CFOs say they are looking for data-driven people for accounting and data analysis.

- They also say that supply chain issues are highlighting the need for investing in operations. CFOs plan to allocate more capital towards improving operational processes, prioritizing operations over sales, marketing, IT, and HR taken together. The goal is to deal with logistical issues by funding new ways for improving business processes.

- Around a quarter of CFOs in the CFO survey admitted that their companies are laggards on tech integration.

How MODLR can support businesses and their CFOs

The challenges are clear and they continue well into 2023. They also resonate across the globe, and are relevant for companies of all sizes, judging by the most recent CFO Outlook for Q2 2023 based on a survey of 500 US SMEs.

But how do you overcome them in a cash strapped, chaotic business environment with stressed customers, troubled supply chains and a workforce that is grappling with high inflation like everyone else, and considering new prospects available for knowledge workers after the COVID-19 pandemic?

Let us take each of these ongoing CFO concerns, discuss their implications on the business and the workforce, and explore how MODLR can contribute in a productive way to meet those CFO challenges head on.

Top CFO Concern #01: High inflation levels and their adverse impacts

CFOs are expecting the currently high inflation levels to create adverse impacts going into at least two years ahead.

Business impacts of high inflation

- Rising labour costs or wage inflation call for improved employee productivity and streamlining processes across the company.

- Higher material and other costs put profit margins under pressure.

- Some sectors may experience lower demand due to the vanishing of disposable incomes as consumers tighten their belts.

- All of this translates to highlight the need for downsizing, and a general need to tighten the belts across all business functions.

Solutions

- Streamline your processes and eliminate the stupid.

- Find more efficient ways of working, with existing or even lower numbers of staff.

How MODLR can help

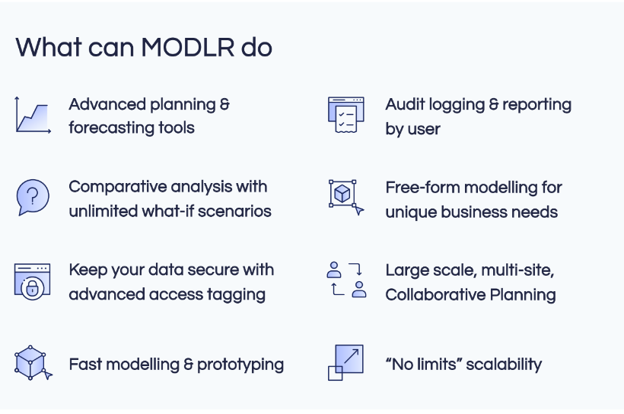

MODLR has been designed for modern businesses. It is for those seeking to streamline their financial planning, budgeting and reporting so they can do it all faster, better and more accurately.

MODLR takes you beyond the confines of spreadsheets to a more productive, speedy, value creating finance function.

MODLR’s free form modelling enables you to make more informed decisions quickly, accurately and in real time.

- Automation of routine reporting functions from basics like journaling to complicated financial consolidations and 3 way forecasting can be easily done using MODLR.

- Streamlining processes and using MODLR will automatically cut down workloads and the length of planning, budgeting, monitoring and reporting cycles. Period end reporting, variance analyses and financial consolidations will happen quickly and efficiently.

- MODLR’s artificial intelligence (AI) enabled support features, including natural language processing capacity, helps users get their work done with speed and efficiency. No need to call support services when you have a question. Just type in your question on the spot and get ready answers from your own system data.

- No limits scalability’ means that any numbers of people can access the company system and any point in time.

- Large scale, multi-site collaborative planning with MODLR on the cloud saves travel time and costs. Everyone can join meetings from where they are, significantly reducing the length of budgeting and planning cycles.

These are just some of the benefits that MODRL offers its users. If you want to improve your business operations, discover how MODLR can help you.

READ MORE

MODLR supports agile, collaborative planning and saves you time and money.

DRL offers Financial Planning and Analysis (FP&A) teams with software tools that support agile, accurate and collaborative planning in real time to keep up with constantly changing market conditions. This calls for a move away from relying on traditional spreadsheets based planning paradigms that are the exact opposite of what the finance teams need.

MODLR steps in to fill the vacuum by offering a Cloud Platform that your financial planners and analysts can tailor to suit your unique business needs.

In particular MODLR can help make your business leaner and more effective:

- Streamline planning cycles and processes to free up your FP&A team's time for high-value adding analysis, strategy and business modeling instead of struggling with spreadsheets.

- Build driver-based budgets at scale

- Create accurate forecasts, including 3-way forecasts

- Empower all department with control over their planning processes and eliminate reliance on IT and Finance.

- Foster a collaborative, data-driven culture

- Enabling all departments—from Operations to HR to Finance—to gain valuable insights from their data to improve their performance.

- Increase the accuracy of targets with driver-based models, real-time calculations, and automatic roll-up across plans and reports.

- Align company-wide plans—corporate plans, annual budgets, daily, weekly and monthly forecasts—with top-down, bottom-up or zero-based methodologies.

- Automate data imports so it's possible to engage in planning with real time consolidated data from across the business.

- Enable easy data integration from multiple sources—from within and outside the business—so there is an up to date single source and single version of truth to ensure accurate and well informed g decisions.

- User friendly and customizable dashboards puts MODLR within easy reach of users across functions, not confined to the FP&A function. This too can take the burden off the FP&A team and speed up processes.

Key MODLR Features for Budgeting, Forecasting and Planning

- Streamline enterprise-wide strategic and corporate plans, annual budgets and monthly forecasts on a unified Cloud Platform.

- Build driver-based plans to champion consistent planning processes across an organization.

- Record and review all budget discussions and decisions along the budgeting cycle for future reference.

- Create role-based access and audit reporting to protect confidential information

- Plan by any time period - day, week, month, quarter, year or any other frequency

- Report, budget and plan with multiple currencies.

Top-down, Bottom-up and Zero-based Budgets

- Define company-wide strategic objectives and cascade allocations from the top-down by key dimensions to align plans, budgets and forecasts.

- Create bottom-up budgets to integrate them into the company-wide strategic objectives

- Improve collaboration and reduce budgeting cycle times.

- Ensure cost-effective company spending; optimize savings with zero based budgeting.

Rolling Forecasts and Cash-flow

- Create rolling forecasts by using the simple “copy” function.

- Model cash-in and cash-out with cash-flow forecasting to support decision-making.

Revenue Planning and Forecasting

- Empower company-wide sales forecasting and pipeline management

- Connect sales, services and other revenue streams to revenue planning models and forecasts to improve the accuracy of plans.

- Connect with your data sources to build accurate and trusted sales forecasts

- Optimize territories to deploy the best sales force for the job

- Compatible with all revenue recognition methods including mathematical and statistical approaches—moving averages, exponential smoothing and linear regression—and revenue planning at account and pipeline levels

- Factor in market and seasonal trends

- Factor in impact of new or proposed marketing and sales initiatives

- Align forecasts with performance and sales plans

Manage Multiple Versions and Create Infinite Scenarios

- Create and compare multiple versions of plans; ensure logical, consistent versioning with unified controls throughout the organization.

- Build infinite scenarios to gain a comprehensive understanding of all outcomes for well-informed decision-making.

Microsoft Excel Add-in

- Excel add-in enables seamless connection between Excel and MODLR.

- Smoothes the transition from Excel to MODLR, removing the hassles of recreating data sources supported with easy integrations.

Flexible, User-owned Business Rules

- No-code, user-friendly formula creation.

- Drag-and-drop and click-and-select to roll-up hierarchies, change currencies and update business rules; eliminating reliance on IT.

Investments, Expansions, Divestments and CAPEX Planning

- View real-time impact of expansions and divestments on financial statements (with 3-way forecasts

- Review impact of capital plans across the profit and loss account, balance sheet, and cash flow statement.

Better Decision Making with Modelling, Analysis and “What-if”

- MODLR helps your FP&A team get into business modelling and creating what if scenarios without recruiting specialized expertise.

- Intuitively build complex models and “what-if” scenarios on-the-fly.

- With real time processing capabilities and smooth data integrations, business modelling does not have to take weeks and months.

Two Top CFO Concerns come together:

Pressure on hiring overall (#02) and hiring more people for data-driven jobs (#05)

Business impacts

A halt on hiring is a widely accepted means among CFOs to meet inflation induced cutbacks. Halting of new hires to the finance function is inevitable. When that happens remaining employees face bigger workloads and more stress. Inefficient processes and not so efficient business tools make matters worse.

Solutions

- More reliance on data analytics. Despite that constraint, or perhaps because of it, most CFOs are seeking to hire more people for data driven jobs in accounting and analytics.

- Investing in better tools and technology is meant to make the business more efficient, effective and profitable. New technology should empower people across the business and make them more productive. Better technology helps people work more efficiently and reduces their stress.

- Combining data analytics and better technology empowers companies and people, offering new and better paths to operational productivity. The mere automation and streamlining of basic processes, help reduce the need for additional staff and reduce workloads of existing staff.

How MODLR empowers with better tech and data analytics

Placing increased reliance on data analytics and investing in better tools and technology go hand in hand since one cannot exist without the other. And MODLR can help on both fronts.

Managing a changing workforce

Business impact

While CFOs are seeking job cuts, employees everywhere—especially the more skilled ones who were able to work from home during the pandemic—are reassessing their priorities. The pandemic has changed their views on work-life balance and quality of life. More are opting to enter the gig economy and seeking more flexible working hours and work practices.

Solutions

- A paradigm change in workforce structures and management. To meet the needs of a more ‘liberated’ workforce has compelled leaders everywhere to kiss the hand they cannot cut off. They are learning to adapt to the new world of talent management, which calls for paradigm change. Forbes magazine offers guidance in, The Post-Pandemic Workplace: 5 Shifts Every Leader Must Make

- In particular, MODLR can help on two fronts: to embed your talent strategy into every phase of your business and to shift your leadership operating model.

How MODLR helps cut down staff costs across the company

Your people may be your greatest asset. But in times of high wage inflation and reduced recruitment, effective workforce planning becomes ever more critical to business success.

In reality many workforce planners are still working with inefficient, error-prone spreadsheets. These outdated practices hinder effective, real time responsive workforce planning and fail to improve organizational productivity just when the companies need it most.

MODLR’s Workforce Planning module delivers a connected platform for HR, Finance and executive leadership to operate with an accurate, single source of truth about labour costs, workforce and their workloads. Workforce planning with MODLR ensures the optimization of your workforce towards achieving company-wide performance goals. With MODLR, workforce planners can respond with agility to changes in the talent markets and recruiting practices.

Key features of the MODLR Workforce Planning Module

Aside from reporting, analytics and visualization, the MODLR workforce Planning module enables you with real time responsive headcount planning, strategic workforce planning, “What-If” scenario modelling, workforce capacity planning and location planning.

READ MORE

Key Features of MODLR Workforce Planning

Headcount Planning

- Building models and planning headcount to align with growth forecasts and financial budgets.

- Hiring plans to determine new position requisition requirements

- Quick draw up of bottom-up or top-down plans

- Improve hiring accuracy and role-ramp-up times, taking into consideration attrition, team role ratio assumptions and all relevant costs.

- Rapidly measure, adapt, and adjust workforce plans when business and financial plans change.

Strategic workforce planning

- Identify and evaluate talent gaps

- Plan out critical workforce details as per long-term strategies

- Forecast workforce supply using up to date mobility, hiring, and turnover assumptions.

- Calculate workforce demand in line with key business and economic drivers

- Create HR programs to support skill development, talent supply, and location strategy.

“What-If” scenario modelling

- Model and evaluate different scenarios to determine the impact on cost key performance indicators (KPIs), headcount and forecasts.

- Analyze the upstream and downstream effects of internal or external changes, drivers, and assumptions.

Workforce capacity planning

- Use demand drivers to quickly calculate workload.

- Determine the optimal workforce capacity across teams and roles.

- Evaluate impact to productivity and overtime costs through modelling capacity against workload to identify gaps.

- Simulate headcount changes and absences

- Analyze potential impacts of organizational realignment, restructuring or M&As.

Location planning

- Simulate scenarios of remote work, by different geographical locations, in-office, or hybrid-approaches.

- Utilize third-party data on talent costs and availability.

- Examine and estimate different cost scenarios for travel of remote employees between facilities.

- Track trends to analyze their impact on your business.

- Optimize employee location plans and strategies to align them with business needs and objectives.

Reporting, analytics and visualization

- Leverage native capabilities for data aggregation to see the big picture and drill down to granular detail to understand the driving factors.

- Leverage analytics, reporting, and dashboards with data visualization to analyze workforce and cost data.

- Rapidly create highly formatted reports to inform decision-making across all levels of the organization.

Top CFO Concern #03: To solve supply chain issues, CFOs plan to invest more in operations.

Business impacts

For most companies, supply chain delays and disruptions began with the COVID-19 lockdowns. Later, they became worse due to many links in the supply chains, especially smaller firms closing shop. Supply chain conditions are expected to get worse before they get better. Supply Chain Quarterly predicts that “Political unrest, raw materials shortages, and rising energy costs will fuel delays and disruptions through the end of the year, and potentially into the summer of 2023.

Today, supply chains are in the C-suite agenda. Many leaders are pushed into acknowledging that business continuity is more important than costs. Traditional buyer-supplier relations have been altered and many companies are now seeking supply chain workarounds.

The traditional inventory playbook is no more. Although just-in-time has given way to just in case supply chains in some industries. But this can be costly, as noted by both Rolls-Royce CEO Warren East and Unipart Executive Chair John Neill in the recently concluded FT Global Boardroom 2022 edition. Instead, they are seeking to bolster up their existing, specialized supply chains with extra financial and business support to get through difficult times.

As the World Economic Forum recounted in early 2022.

Bold companies are not waiting for supply lines to untangle themselves – retailers short on storage space are buying warehouses, shippers that can’t find containers are making their own, and companies unable to book with ocean carriers are chartering vessels, while those unhappy with their online sales are buying e-commerce fulfilment operators.

Amazon and shipping giants Maersk and CMA CGM are moving into air freight. Maersk and CMA CGM, in fact, appear to be on a collision course with Amazon and Alibaba in logistics, forwarding and delivery.

According to the CFO survey “Nearly half (46%) of CFOs surveyed said capital will be allocated to improving this part of their organizations. Beating out sales, marketing, IT, and HR combined…”

According to the McKinsey Supply Chain Leaders’ survey of 2021, only two percent of those surveyed had supply chain visibility beyond the second tier. And around one in 10 (11%) had no supply chain visibility at all. Remember, the survey is of supply chain leaders!

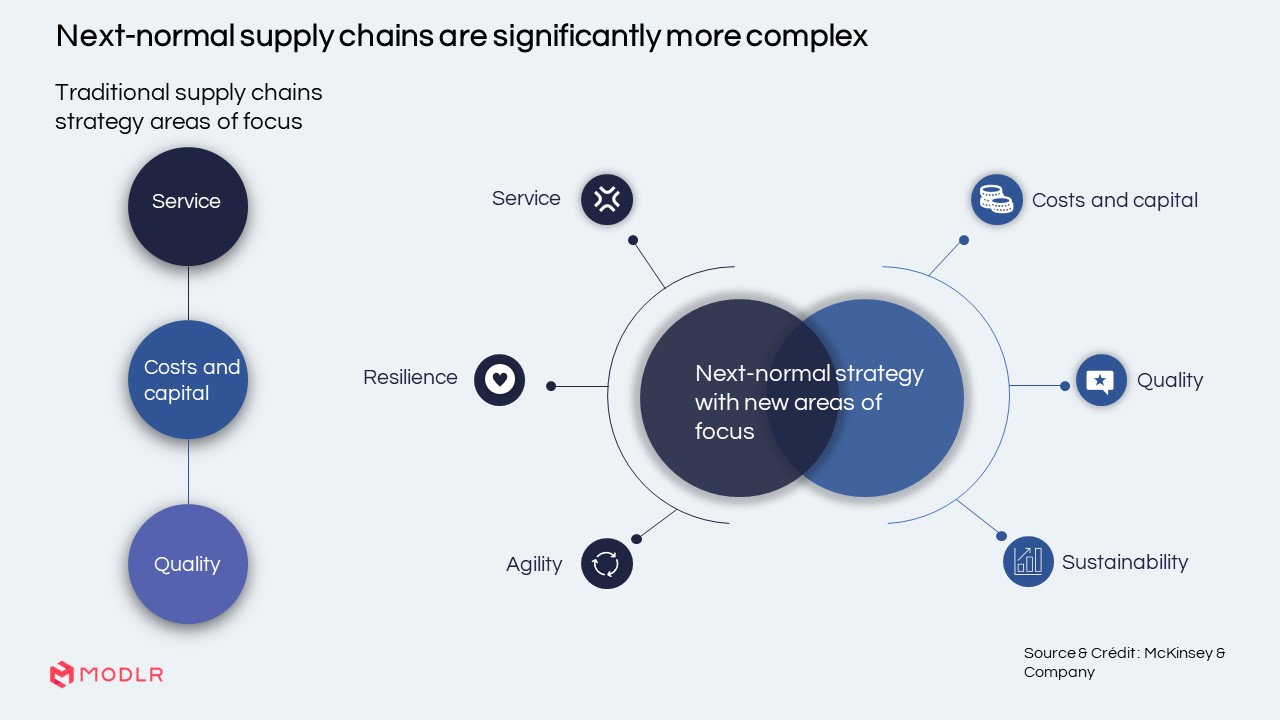

Solutions

- Future proof supply chains. As they deal with the new-normal supply chains, companies recognize the need to strategize beyond the simple cost and capital, quality and service focus of the supply chains. To future proof the supply chains, they need to aim for resilience, agility and sustainability of their supply chains.

- Resilience comes from visibility, flexibility and access to quality master data. Resilient supply chain plans are built on three interdependent pillars of end-to-end (E2E) visibility, recognition of scenarios and sufficiently high master-data quality.

- To get there, companies must invest in advanced analytics. In fact, most surveyed industries in the supply chain leaders’ survey said they had invested in supply chain advanced analytics during the pandemic and that they planned to continue. Those companies that already met these criteria were much less affected by the supply chain challenges they faced during 2022.

How MODLR can help improve supply chain metrics

- Logistics and Supply Chain Solution. Aside from enabling businesses to better plan their operations, MODLR’s procurement and spend analytics solution for supply chain and logistics can help improve cash flows tied up along the supply chain.

- Spend analytics benchmark procurement spend across the business and enable uncontracted (uncommitted) spend to be consolidated for optimal pricing.

- Real time variance analyses also helps optimise operational performance.

- Scenario analysis c an be performed using MODLR where companies seek to improve supply chain performance with changing inventory levels, adopt just-in-case alternatives or opt to support their suppliers downstream to weather difficult times.

Top CFO Concern 04: CFOs are embracing new technologies and seeking technology integration

Business impacts and solutions

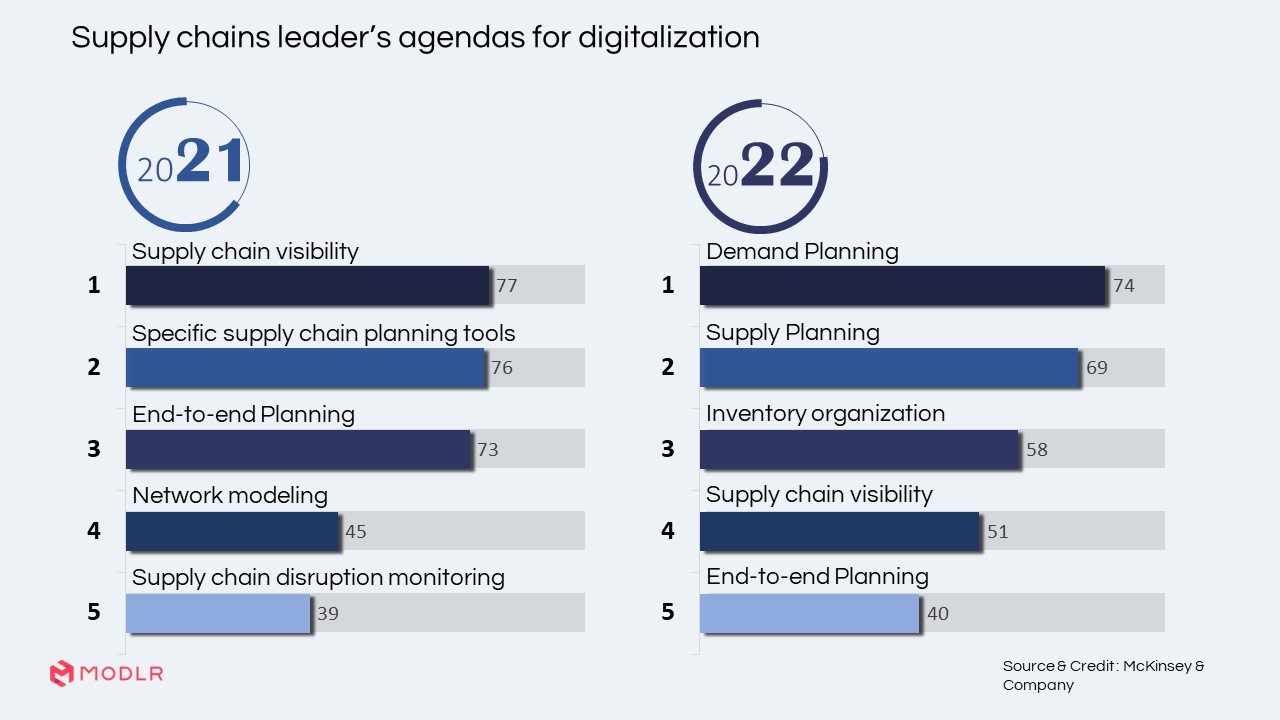

In contrast with their priorities in the previous year (see chart), the McKinsey 2021 survey showed that digitization priorities of supply chain leaders have shifted from gaining visibility, a focus on supply chain tools and disruption monitoring towards a more integrated approach to supply chains including demand and supply planning, inventory optimisation, that also includes enhancing supply chain visibility and end-to-end planning.

Source:

Technology integration in the finance function, and across companies has been a sticky issue that has put many a digital transformation project on hold. The issues are complicated, but for survival, companies need to resolve them.

How MODLR helps with data integration

MODRL enables smooth technology integration. MODLR users can easily shift to an integrated planning approach across all their operations including in supply chain and logistics functions. MODLR on the cloud has many features to offer companies that face integration issues.

- Smooth and easy integration. MODLR has been created to work smoothly with commonly used business software and platforms including ERP software including Microsoft Business Central, Oracle NetSuite, SAP, TechOne, Jobpac, Xero, MYOB, Quickbooks and Sage, among others.

Find out more about MODLR

MODLR, built with FP&A professionals in mind, can offer much to a CFO grappling with the challenges that face their businesses and the finance function today.

Contact MODLR today to find out more on how we can specifically help your business and its unique business needs.