Within the next two years, a new financial era is beginning to emerge and cause radical changes within the financial sector. These changes are expected to create a significant impact on to the current model of operations and will breed a variety of new trends and factors for the finance industry to navigate through. To help financial institutions prepare for the upcoming changes, the following article outlines these trends and factors, providing an insight into the necessary skills and disruptive technologies crucial to surviving the new financial era.

FinTechs disrupting financial operations models

The stability of the banking industry is being threatened with changing models of operations and the rise of FinTech disruptors in the financial services market. Disrupters, in this case, are usually start-up companies that have high levels of mobility. Each disrupter is typically focused on a specific innovative process or technology within the financial services value chain - often in one of the most profitable elements such as mobile payments and financial investment. Due to this 'selective investment' strategy by FinTechs, banks are being outperformed in their most profitable financial services, and are losing revenue. As a result, investments in FinTech are surging as their potential to impact on the financial sector is being recognised, and this growth will only increase with the rise of Open Banking.

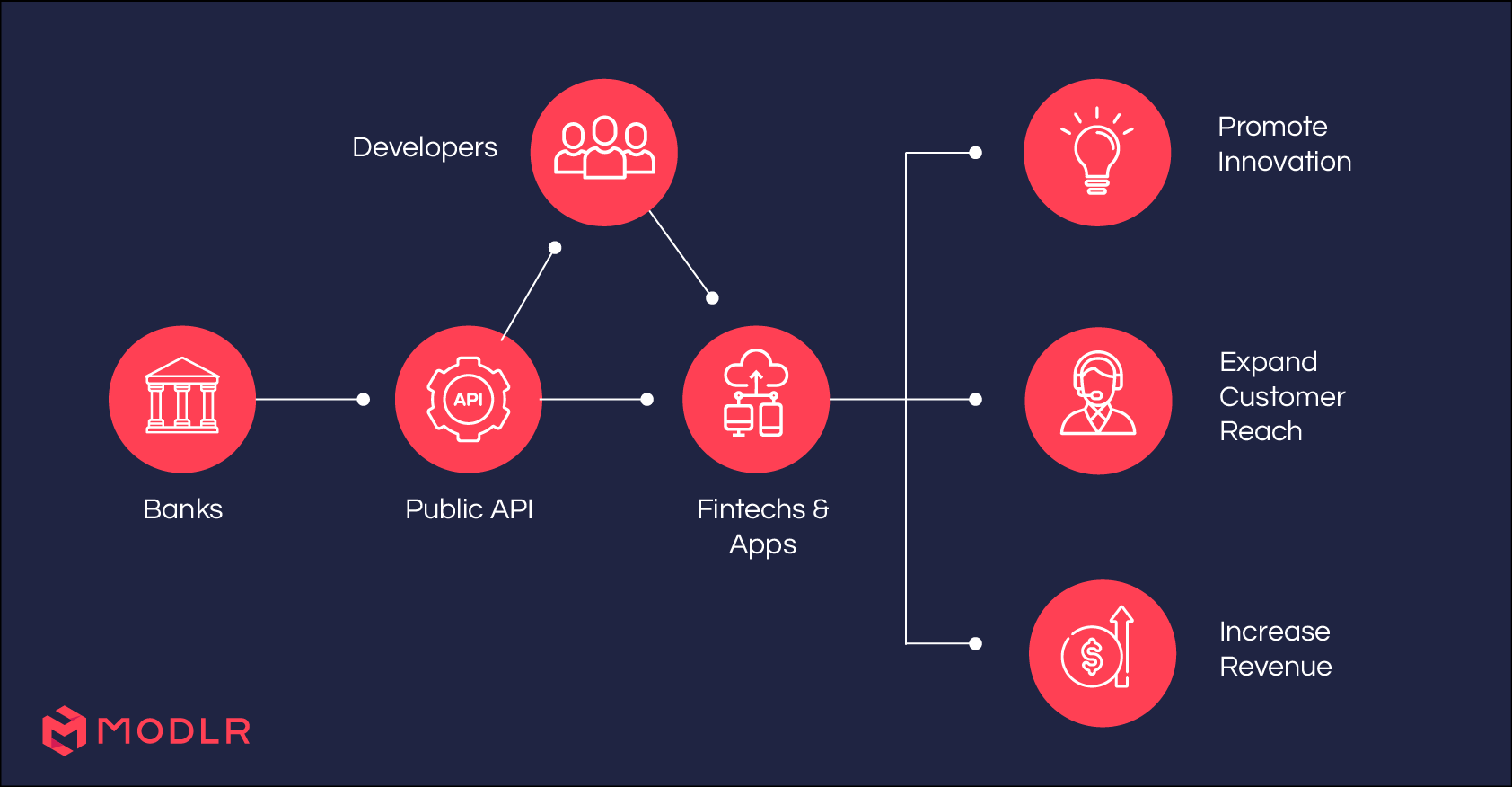

Open Banking changing customer leverage

Open Banking provides a standardised and secure framework for sharing data from bank customers with their financial service providers. Consumers will gain ownership of their financial data, which will be moved to an open API. A consumer's financial information can then only be accessed by the appropriate financial service when the customer has given permission. As consumers can now have control over their own financial information, they gain certain benefits including, but not limited to, faster processes of opening up multiple new bank accounts, getting loans, or accessing the financial services of different FinTechs, banks or other competitors. This makes it that much easier for FinTechs to innovate and compete against established banks, as the latter will no longer have the same leverage over their customers.

Increased FinTech collaboration within the banking industry

With the rise of Open Banking, the whole process of banking itself is changing and moving towards a digitised platform. Traditional banking processes now face an overhaul, and the financial sector is more focused on providing a positive and efficient customer experience rather than seeking to cut costs. This has lead to increased collaboration between banks and FinTechs. Using innovative technologies of FinTechs, banks can gain access to cheaper yet more effective financial services for their clients, offering better customer experience. Such collaboration opens up new possibilities and opportunities within the finance industry.

Mainstream digitisation of business

In today's modern business, internet development and technological innovation have vastly increased efficiency; and business, in its turn, must adapt to and embrace these new technologies. This technology-driven agenda applies to all aspects of financial services; from customer experience to operational efficiency and analysis. Services such as wealth management and insurance have already greatly benefited from technological advances, as will institutional areas such as commercial banking.

Blockchain technology in finance

Developments in Blockchain technology are expected to impact heavily on financial services. Financial services will benefit from its improved security, its cost and efficiency. PwC has predicted and openly stated that the use of the "Blockchain Public Ledger" will be an integral part of the operational infrastructure of financial institutions.

Customer-centric services for the future

The finance industry has, in recent years, invested heavily in enhancing the customer experience. The rise of Open Banking, FinTechs and Blockchains has rendered the current banking model unsustainable. In modernising, many banks have broken down their core values of customer service and refining them. By understanding what customers actually value in financial services, and analysing the flood of financial data about their consumption behaviours, banks are able to develop new customer-centric initiatives.

Robotics and AI advancement

New alliances have been forged between financial services and technology companies in the wake of the digital era. It has become commonplace to use robotics and AI to reduce costs, enhance efficiency, mitigate risks and analyse opportunities of growth. Robotics and AI technology are constantly improving, producing new innovation in social and emotional intelligence, natural language processing, pattern-identification and independent learning. The subsequent improvements in autonomic and efficient processing will change the landscape of the financial services industry. Traditional high street banks and the skills needed to operate them will become increasingly redundant; and in their place, new skills to operate in the digital era will be required- such as developing AI and coding.

Service robots themselves are on the path to replacing bank tellers and customer service from staff. They are able to respond logically, respond to the environment and objects around them and offer learned responses. While they are still in early developmental stages, with many technological hurdles to overcome, evolutionary developments are expected within the next 5 years, with exponential growth following.

A dominant cloud-based infrastructure model

Cloud-based computing is continuing to gain ground within the finance industry and is expected to become the dominant infrastructure model. At this moment plenty of financial institutions are using cloud-based SaaS (software-as-a-service) for business processes such as HR, financial accounting and analytics. These processes can be considered to be 'non-core' processes, but as cloud technology advances it is expected that, by 2020, 'core-activities' will be encompassed with cloud-based technology. Such areas include credit scoring and customer payments.

Cyber-security in finance

The need for cyber-security in the financial sector cannot be overemphasised. PwC's 2016 global CEO survey reported 69% of CEO's within financial services were "somewhat or extremely concerned" about cyber-threats. These cyber-threats are only expected to grow as technological advances mean more opportunities and more sophisticated forms of hacking. The increasing population of third-party vendors, cross-border data and usage of mobile technology only exacerbates the problem.

Relocations of 'middle-class' populace to Asia and Africa

PwC predicts a worldwide boom of 'middle-class' citizens over the next 30 years alongside an expected migration of 1.8 billion people globally, mostly to Africa and Asia. Due to the rise of an economically wealthier and more skilled populace, there will be a rise in opportunities for financial institutions. Technologically-driven innovation will revolutionise the computing and telecommunications industries of these developing nations and create job opportunities with metropolitan growth. Increased urban development will draw a greater middle-class populace into these emerging markets.

Regulators forming technological alliances

Regulators are increasingly using data analysis and gathering tools to navigate the ever-changing landscape of financial institutions. To create effective regulation and to predict problems, complex analytics are being used to perform scenario analysis. As a result, there will be collaborative opportunities for FinTechs and technology developers to assist and improve the technological processes around regulation.

Preparing your business for 2020

1.Update your operating model

Updating your operating model as soon as possible is crucial, as it may well be outdated by 2020. Financial institutions and their IT organisations must be prepared for, and ready to adapt to the constantly changing digitised world.

2. Link technological capabilities to customer needs

Businesses need to develop, and use effectively, their customer intelligence. Understanding customers and building the best experience for them is of paramount importance in the finance industry as the new operating model of service will be customer and context-centric. The interaction between financial services and customers change as customers gain greater control over their own financial data.

3. Maximise interconnectivity within systems architectures

As technological systems grow more diverse and complex, your systems architecture needs to be connected to as many endpoints as possible. Integrating cloud services, internal and external stakeholders and 'big data' sources into your architecture are just a few of the necessary measures. Improved without diminishing connectivity, greater security measures will be needed to counter cyber-threats.

4. Cyber-Security, Cyber Security, Cyber Security...

With increasing cyber-security risks it is essential to update and strengthen your cybersecurity. These security risks will quickly render traditional cyber-security obsolete. Financial institutions must update their security technologies to ensure the smooth running, and the very survival of their businesses.

5. Hire the right talent and skill sets for the future

As digitalisation and a changing operational model of service approaches, financial institutions will need varied sets of skills within their talent pool. New employees need to be selected according to their technological skills, customer/client service abilities and diversity of culture and background - the existing talent pool of staff will require upskilling.

6. Cutting costs by adopting efficient technologies

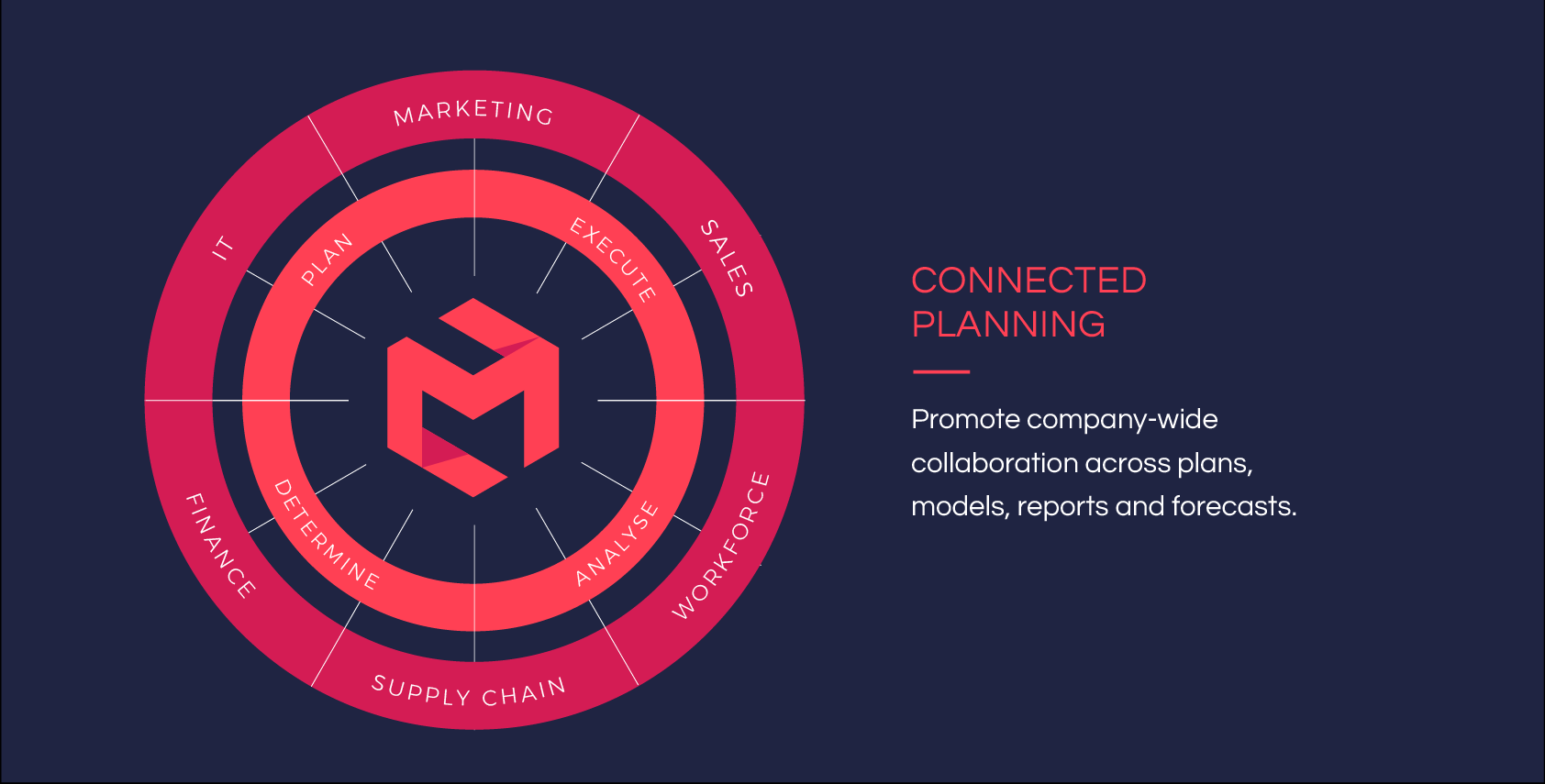

The adoption of effective AI and cloud-based technologies is key to reducing operational costs. The use of these technologies will streamline operational processes and FP&A cycles - reducing operational costs by promoting collaboration between all departments, company-wide. Such savings will enable financial institutions to put more resources into models of cyber-security, technological innovation and hiring.

Implementing cloud technologies reduces process times to speed up decision making and unites planning across all departments.

How MODLR can help:

MODLR helps businesses to establish and understand their management strategy, and establish consensus on forecasts and budgets involving each manager based on their responsibility level. MODLR is a secure cloud-based business modelling platform, offering a range of features tailored to your company's needs.

MODLR offers:

- Secure cloud-based technology enabling real-time edits and interconnectivity under one unified platform.

- Streamlining and promoting company-wide collaboration in financial processes including budgets, forecasting, and planning.

- An adaptive interface able to integrate with existing company software.

- Rapid reporting, using our Natural Language Processing technology in MODLR's Discovery Dashboards, to enable efficient decision-making and execution.

- Conversion of customer data into trends, categories and models to highlight commonalities and priorities.

- Clear performance analysis of internal KPIs, goals and operations.

- Greater lead times to prepare for performance gaps.

Stay ahead of financial trends and the changing operational models of services with MODLR. Book a free consultation here.